One of the challenges of focusing exclusively on any one thing is the inability to think outside of that context. I previously worked with a client who for years had been one of the undisputed leaders in their narrow industry niche. They had developed a leading edge, proprietary technology solution and invested in new production facilities to meet what was expected to be huge demand. Despite all forecasts to the contrary though, an unexpected, exogenous event seemingly flatlined the market overnight. The dissipation of demand put the outlook for the company in doubt. The client then had to consider the uncomfortable question, “What do I do now?”

The solution required taking a step back from the market they knew and considering alternatives in a disciplined way. I worked with the client to think about the strengths of their franchise: unique and patented technology, high quality engineering staff, and newly expanded manufacturing capacity. We then considered whether those capabilities could be redirected into different solutions to create value, even if some changes were necessary to meet customer needs in an unfamiliar market. Together, we found several material new business opportunities outside of their traditional space that were surprisingly within reach. By making a strategic shift into these new applications, the client was able to sidestep the current crisis and open up new avenues for growth.

This approach, which I’ll call a Tangential Strategy Analysis, first focuses on the distinctive qualities of a company’s product or service and how those capabilities might address unmet needs beyond the current market space. Then it considers what it might take to move into a new market to pursue these opportunities and how commercially attractive the opportunities are. Finally, it helps frame up a roadmap for how to get there. This analysis is flexible enough to work for any type of business and is summarized in the five steps below.

- Competitive attributes: The first step is to define the most distinctive features of your company, product, or service. While it may seem straightforward, this exercise often requires a few iterations to get right. You are looking for outstanding, competitive capabilities that you can offer and others cannot. Start big picture and work downwards, putting aside things that are more commonplace while narrowing in on aspects that make what your company does special. Think about:

- What problems do you solve for your current customers?

- What is it about your product or service that is better than what is offered by competitors?

- Is your capability unique, hard to replicate, or protected with patents or trade secrets?

- Why specifically do customers buy from you as opposed to a competitor?

The key to this step is to clearly describe four to five distinctive strengths that you can then use in a different way to solve customer needs in other markets.

- Alternatives: The next step is to use your competitive attributes to identify potential applications beyond your typical markets. This process can be outside of the comfort zone for many people, so is often best done as a collaboration or brainstorming session to get the broadest thinking possible. Identifying potential alternative applications should follow a systematic and iterative process. A good way to begin is to consider immediately adjacent industries with similar applications and then progress further afield.

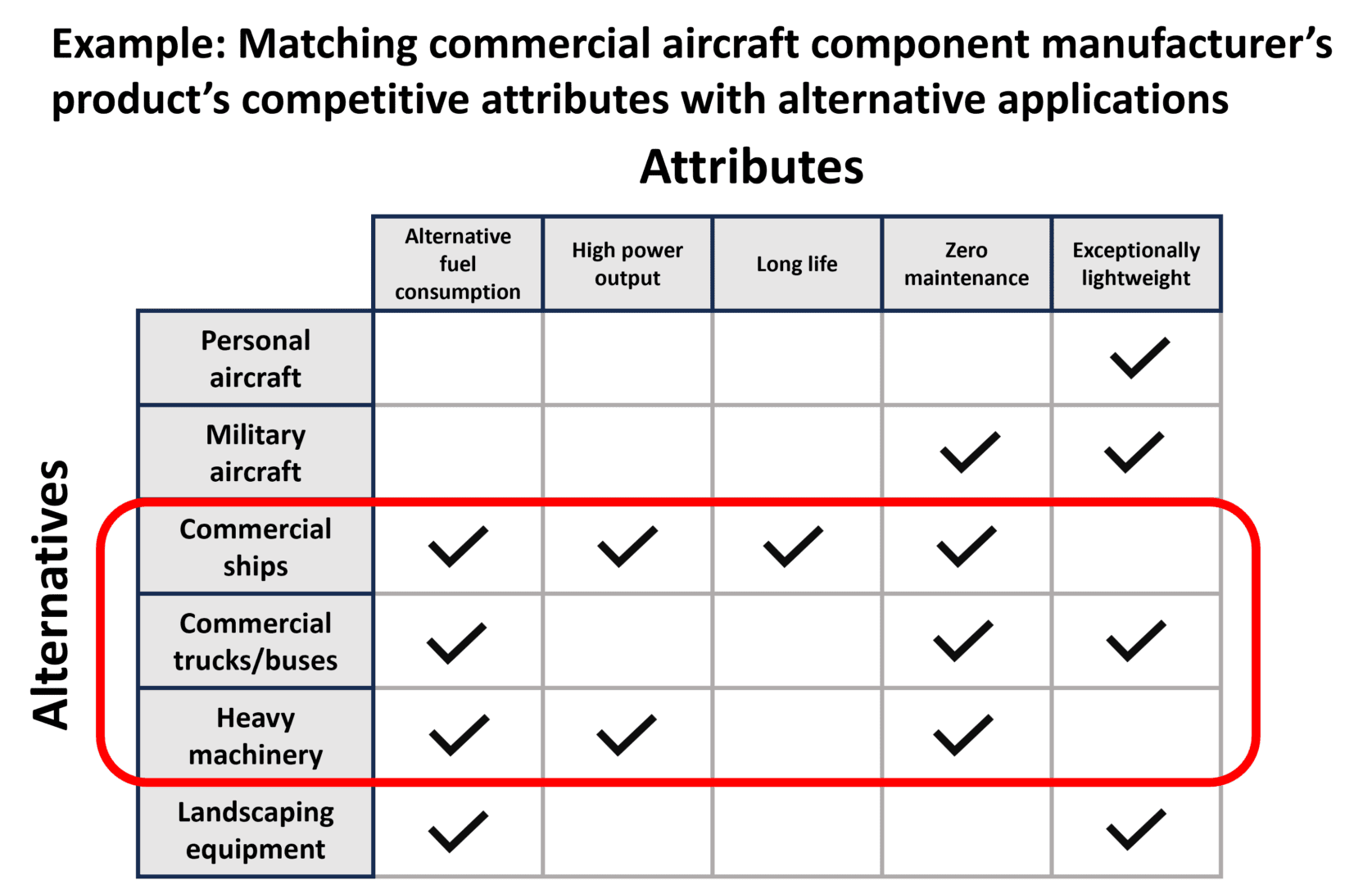

In the following example, we can consider a company that predominantly makes components for commercial aircraft. To identify alternative applications, I would ask their management team:

-

- Are there similar commercial aircraft components that you do not make today?

- Are there other aerospace applications that might value your capabilities?

- What about applications in other transportation markets?

- How about similar applications in unrelated markets?

Next we would construct a table with a separate column for each one of the firm’s competitive attributes. We would then convert the table into a matrix by creating a series of rows, each labeled as an individual alternative application. To discern areas with the most potential, we would leave a mark in cells where there is a match with one or more of the company’s current competitive attributes.

When you do this kind of analysis, do not expect a perfect match with all of your attributes, and do not be surprised if there are cells with no matches at all. After all, you are considering options to break into new markets. Do look for recurring themes where your capabilities are valued, as it will help guide the identification of other potential alternatives.

The goal of this step is to rapidly screen out non-starters while assembling an inventory of options that are worth assessing in more detail because they value some of the capabilities you can offer. The options do not have to be ‘plug and play’ opportunities where you simply change the packaging and sell into another market. Focus on options where there is some synergy with what you do well, even if you are not positioned to move on them today. What is required to translate them into meaningful opportunities is evaluated next.

- Assessment: Consider three dimensions to gauge the feasibility and commercial attractiveness of each of these alternative applications.

- Complexity: How much of a stretch would it be to break into this market? Why? Who are the competitors? What are the barriers to entry? Is investment required?

- Scope: How many units of volume are in demand? What does this demand look like in the future? Who are the customers? How broad is the customer base? How do they buy?

- Size: What is the market size today? What is the market size expected to be 5-10 years from now? How many units would be required to capture 5% of the market?

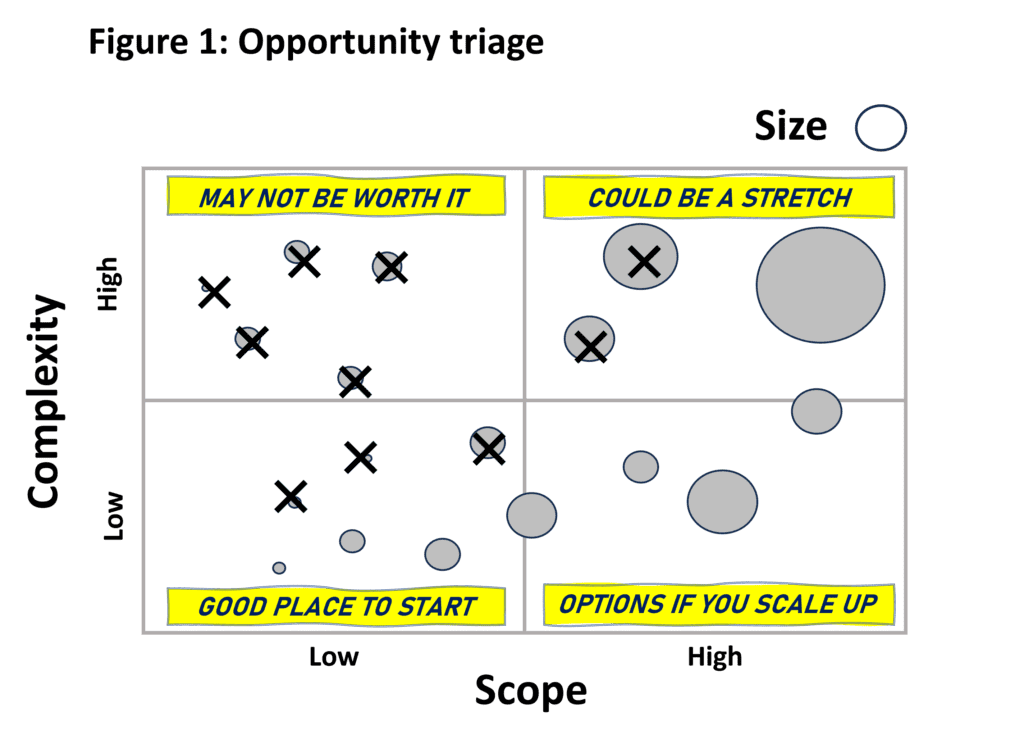

After capturing the details about each alternative, assign it a relative score for both complexity and scope for ease of comparison. You can then plot the alternatives in a simple two-by-two matrix, incorporating a third dimension for size, to get a visual bubble chart summary of your portfolio of options.

- Triage: A bubble chart graphic, such as Figure 1, is a helpful aid to refine and prioritize the different opportunities into a more targeted list to build an actionable strategy around. Think about the risk and reward tradeoff for each opportunity. Consider the time, investment, and scale necessary to address the scope of the opportunity. If something does not make sense, cross it out. Also look for any supporting connections between opportunities and whether pursuing one improves your ability to subsequently pursue others. Doing so will help further narrow down the list of target opportunities and also offer some insight into which opportunities to pursue first.

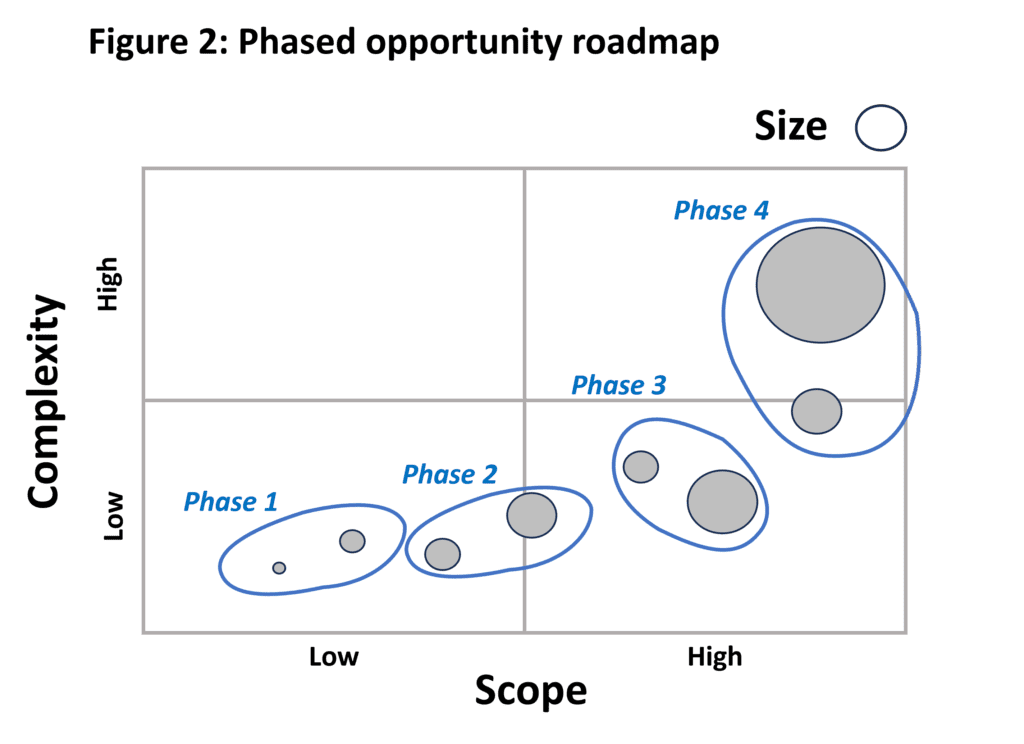

- Roadmap: The final step is to construct the action plan needed to pursue these tangential opportunities. The plan will need to factor in the actions and investments necessary to address the complexity and scope requirements previously identified. Overcoming these constraints can take time, especially for more operationally distant applications. Therefore, it may be best to plan in successive phases starting with the opportunities within closest reach, as illustrated in Figure 2.

A phased approach can provide several benefits. A Phase 1 ‘proof of concept’ targeting near-term opportunities can offer a quick payback, build internal momentum and buy-in, and validate the assumptions used in the opportunity assessment. A follow-on Phase 2, targeting larger opportunities, could build from those initial successes while simultaneously increasing internal capacity to meet market demands in new applications. Subsequent phases could then be directed at even larger opportunities that were initially out of reach, but are now much more in line with your capabilities.

Of course, you do not have to wait until things go sideways to apply a Tangential Strategy Analysis. Incorporating the approach into regular strategic planning is a disciplined way to identify new sources of growth. By anchoring the analysis to competitive attributes, it helps ensure that the options identified are not only feasible but defensible as a new market entrant. Alternatively, a similar capabilities-based approach is a good way to improve your competitor analysis by identifying potential disruptors and new entrants from unexpected quarters. Widening your focus with a Tangential Strategy Analysis can help you look around corners, spot opportunities and threats, and position your business for long term success.

Is a Tangential Strategy Analysis right for your business? At Ascendence Consulting, we partner with leaders to overcome challenges and deliver growth. Contact us for a confidential consultation.