Most financial institutions focus their compliance efforts on risk management and operating within defined regulatory boundaries, such as capital adequacy, fair lending, and anti-money laundering. However, if regulators perceive a firm’s strategic plan as weak, such deficits may trigger increased scrutiny, consent orders, and fines. Boards and Management teams that cannot evidence a robust strategic planning process and effective oversight could put their organization’s long-term ambitions at risk.

In the wake of the 2023 mini-financial crisis, there is a renewed emphasis on institutional resiliency, Board oversight and regulatory supervision. Both state and federal regulatory agencies are under increased pressure to safeguard the stability of the financial system. While the overall system held, the five US bank failures last year exposed gaps in the management of some institutions. The general consequence for all banks, regardless of size, is a more aggressive and less flexible supervisory approach. Banks that fall short of regulatory expectations could see their growth outlook falter as financial penalties, commercial restrictions, and remediation expenses disrupt their momentum and demoralize their staff.

Bank resiliency and strategic planning are therefore receiving increased attention, and they are not just large bank considerations. In October 2023, in an important shift, the Federal Deposit Insurance Corporation (FDIC) proposed corporate governance standards similar to those reserved for the largest banks to apply to significantly smaller institutions. Over the last twelve months, the Office of the Comptroller of the Currency (OCC) issued more than three times the number of enforcement actions with a strategic plan component to small and mid-sized institutions, compared to the previous year. Impacted banks quickly had to submit a revised, Board-approved plan for review; pending no supervisory objection, they also had to operate narrowly within the parameters of what would most likely be a much less ambitious business strategy.

The concept of what is required for a robust and resilient strategic plan appears to be increasingly consistent among regulators, even if some federal or state agencies have not yet documented those standards. Taking steps today – before there is a compliance issue – to understand and adopt “Heightened Standards” strategic planning principles is a diligent move for organizations. It not only provides a level of comfort regarding potential regulatory exposure. The real benefits derive from the planning discipline that helps to ensure there is adequate coordination, risk management, oversight, and accountability to successfully deliver the bank’s overall strategy.

What are Heightened Standards?

In 2014, the OCC established “Heightened Standards” guidelines for the governance and oversight of banks following the upheaval of the 2008 financial crisis. These increased expectations cover not only risk management, but strategic planning as well. The codified standards apply to insured national banks, insured federal savings associations, and insured federal branches of foreign banks with $50 billion or more in average total consolidated assets.

Heightened Standards requires a CEO to develop a written strategic plan covering at least a three-year period. The planning process should consider both the current state of the organization as well as future strategic ambitions, and articulate what actions will be taken and how progress will be measured to meet those goals. The plan must be prepared with input from front line units, internal risk management, and internal audit. It must be reviewed, approved, and monitored on an ongoing basis by the Board of Directors and updated to reflect changes in risk profile or the operating environment.

At a high level, the strategic plan must include:

- an overall mission statement, strategic objectives, and an explanation for how these objectives will be achieved,

- a comprehensive assessment of risks, and

- an explanation of how risk governance will adapt to account for changes.

In practice, however, these requirements are just a starting point. The documented expectations are a guideline – not an explicit rubric – and so the actual requirements are ultimately subject to supervisory interpretation of what is necessary, given the institution’s history and market conditions. Regulatory supervisors are also under no obligation to clearly state what “good” looks like.

Applying Heightened Standards in strategic planning

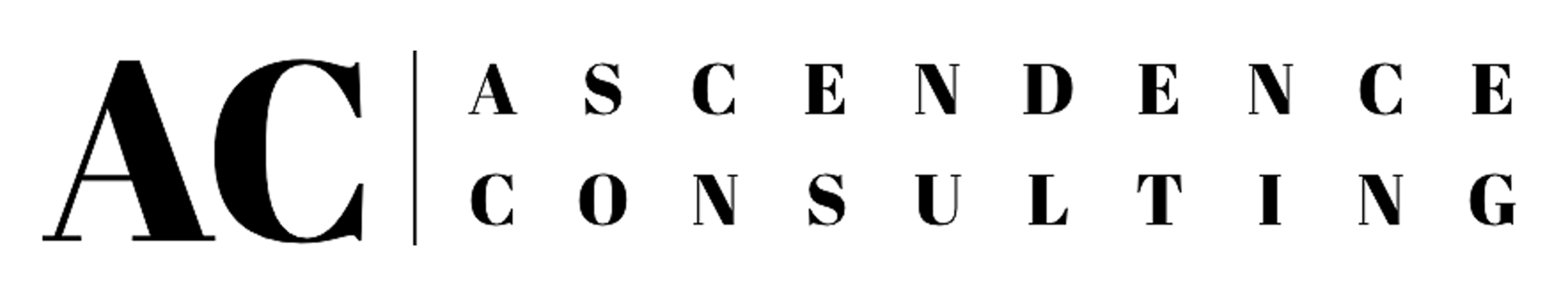

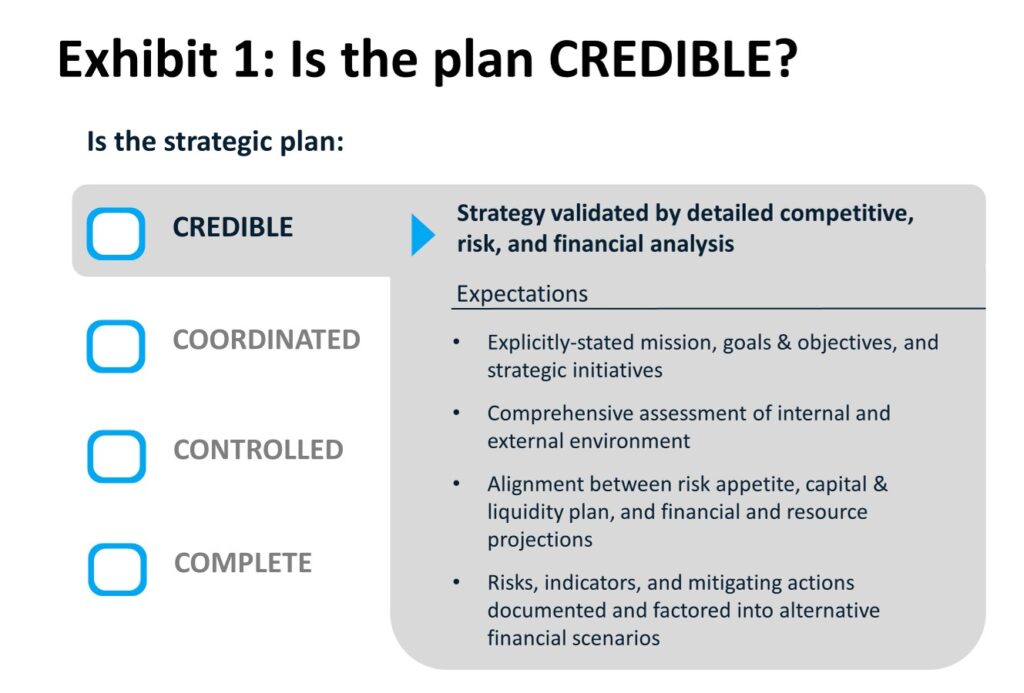

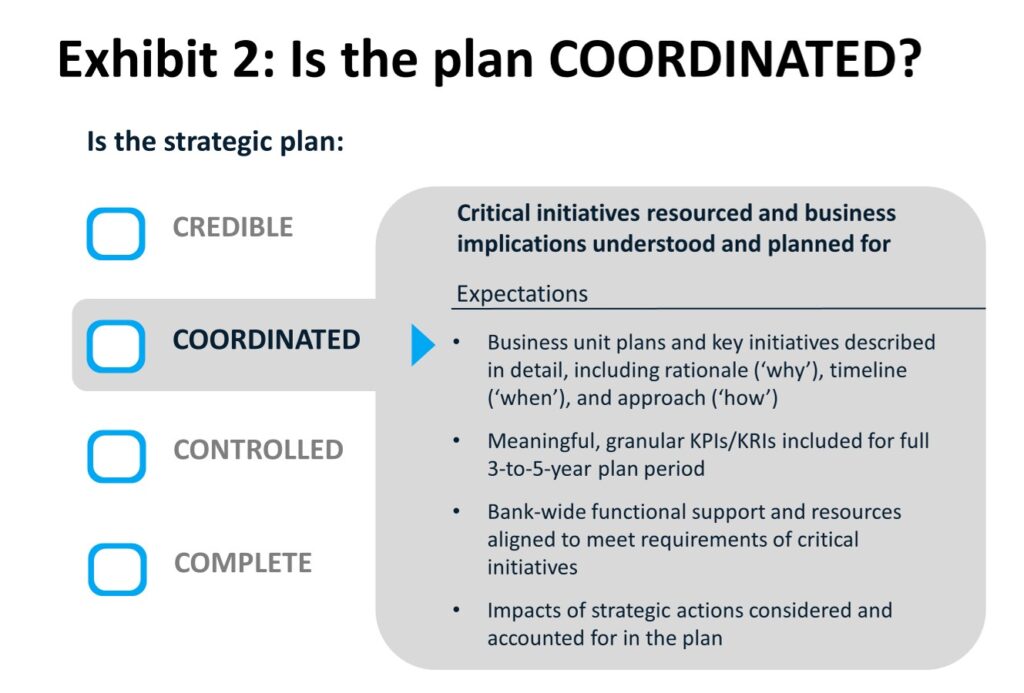

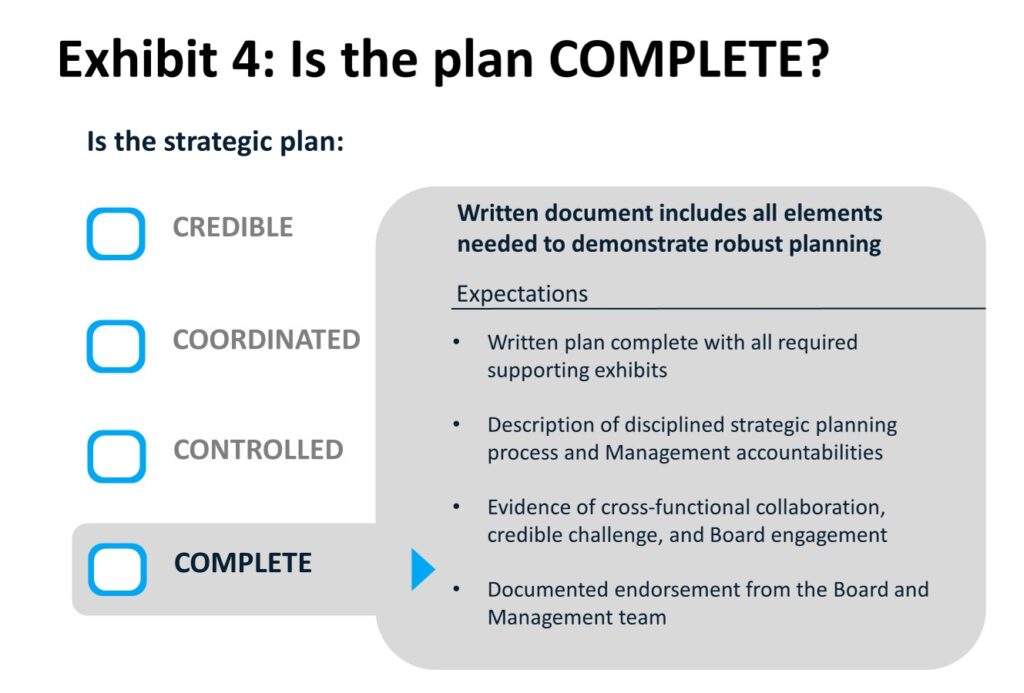

Based on my own experience over the last decade, I have learned that it takes a good deal more than the minimum to demonstrate sufficient resiliency and robustness in strategic planning in order to meet expectations. Regulatory assessment of the adequacy of strategic planning, described as Heightened Standards, is not a judgement of how clever, innovative, or compelling the strategy is. Nor is it about the number of pages, the clarity of exhibits, or the size of the financial projections. Heightened Standards is about employing a process that combines situational awareness and commercial ambition with financial and risk management discipline, internal coordination and effective oversight. To ensure an institution meets these expectations, I recommend applying four tests to confirm that the plan is credible, coordinated, controlled, and complete.

1. Credible

Supervisors will review the written strategic plan to better understand what the institution aims to accomplish and how it will compete over the subsequent three-to-five years. This should be explicitly addressed in an upfront summary that includes a mission statement supported by clear goals, objectives, and discrete initiatives. The summary should concisely communicate the intent and general path the organization will take to be successful in terms that are easily understood by both internal and external audiences. The balance of the strategic plan should provide supporting proof that validates that forward-looking ambition and present a more detailed roadmap for how the organization will achieve it.

The plan needs to demonstrate that the strategy is reasonable and grounded in an awareness of the competitive environment (Strengths / Weaknesses / Opportunities / Threats). Internal and external risks should be inventoried and evaluated, with actions identified to address gaps and mitigate exposure. The multi-year financial plan should clearly operate within risk appetite limits, capital and liquidity requirements, and resource availability. Assumptions and expected results should be tested with additional analysis featuring alternative scenarios, business implications, and associated contingency plans. Evidence of robust planning builds credibility and confidence in the strategic direction of the institution.

2. Coordinated

Business unit plans and key initiatives that deliver the impetus to achieve the institution’s strategic goals and objectives should be articulated in detail. Each should be supported by a business case with a clear rationale, target outcome, and linkage to the overall bank strategy. Operational details, such as actions, accountable owners, risks, and resource requirements, should be detailed along a timeline including quantitative and qualitative target outcomes. Key Performance Indicators (KPIs) and Key Risk Indicators (KRIs), forward-looking metrics that confirm progress or provide early warning of issues, should be determined for the entire three-to-five year period. Plans for bank-wide functional support, such as human capital, physical assets, technology, investments, and other demands should be synchronized across business units and initiatives.

Cross-functional reviews, which include participation by business unit and support function leaders in the refinement of the plan, can help ensure adequate allocation of available resources. Taking advantage of different viewpoints, these discussions can also be used to pressure test initiatives. They can identify any necessary modifications to existing processes, policies, or information systems required to properly deliver the strategic plan across all business areas. Collaborative challenge sessions can also identify unanticipated external (e.g., client conduct, regulation) and internal (e.g., staffing, funding) implications that will need to be addressed. Coordination during the planning process improves the cohesiveness of the plan and its likelihood of success.

3. Controlled

Sound governance is an essential aspect of Heightened Standards during both plan development and delivery. The Board should be actively engaged and provided the information and leadership access needed to execute their oversight duties. The strategic plan as a whole and individual initiatives should include clear lines of accountability, escalation, and decision-making authority to speed responsiveness as conditions change. There should be a formal process to introduce changes to the strategic plan or, in more extreme cases, enact contingency plans when needed. Ongoing monitoring should be accomplished through regular progress reviews supported by reporting with meaningful milestones, metrics, and financial results.

The written strategic plan should include a section that explains how the Board and Management team will govern the execution of the strategic plan, including forums, cadence, and participants. Key inputs, including progress reports, financial targets, KPIs, and KRIs, should be agreed between the Board and Management at the onset. A centralized program oversight office can be used to facilitate governance, coordinate actions, and offer an extra degree of robustness to plan delivery. Minutes from Board and Management meetings should reflect the ongoing monitoring of the objectives, performance indicators, and risk factors that are articulated in the strategic plan, as well as the discussion of, and any agreement to, changes in strategic direction. These features illustrate the controls necessary to keep the organization on track, even as conditions change over the course of the plan period.

4. Complete

The written plan needs to be thorough enough to stand up to external review on its own, without verbal explanation. A good practice is to draft a checklist of plan requirements and accountable owners to ensure that all elements are addressed. Cast against a timeline that includes review and coordination steps, the checklist provides a solid foundation for the strategic planning process that supervisors are looking for.

As a complement to the plan itself, organizations can use an appendix to include evidence of that deliberate approach. The appendix should include a clear explanation of the planning process including roles and responsibilities, cross-functional contributions, critical assessments, and resource coordination. It should provide supporting documentation that memorializes those key procedural steps and include explicit endorsements from each member of the C-Suite and the Board of Directors. Provided as a complete package, the document offers transparency and demonstrates Management’s confidence in the strength of the planning process.

What’s next?

Financial institution oversight is a complicated area, given the often-overlapping roles of the OCC, the FDIC, the Federal Reserve Board, and other federal and state regulatory bodies. While Heightened Standards was initially designed to regulate large banks, in the absence of separate review criteria, smaller institutions increasingly may face similar expectations for strategic plan rigor, describing their safety and soundness.

Adapting to Heightened Standards does not have to mean introducing unnecessary bureaucracy that stifles strategic thinking or burdens management. Heightened Standards sets a framework in place that helps Boards and executive teams better meet their obligations to manage the safety and soundness of the institution. By incorporating things like scenario planning, resource prioritization, and cross-functional participation, they can smooth out execution and head off potential roadblocks. Organizations with confidence in their existing planning process can gain additional credibility with minimal effort by documenting this activity in their strategic plan. Others can follow this guide to build assurance in their processes while addressing gaps and formulating a more robust and repeatable process. Done right, these disciplines should improve the quality of plans and increase their likelihood of success.

Does your bank’s strategy meet Heightened Standards? It is well worth the investment to be certain that your institution’s strategic plan can stand up to external scrutiny. Ascendence Consulting offers a rapid turnaround strategic plan review and assessment, based on years of first-hand experience, that can expedite the process, identify any gaps, and provide the confidence you need to focus on your organization’s strategic agenda.

We partner with leaders to overcome challenges and deliver growth. Contact us for a confidential consultation.

Jeffrey S. Barden

Managing Partner